1925

10 min

The Guide to Tactical Planning Challenges in FMCG. Insights from Natalia Morozova

When talking about planning in the FMCG industry, you need to keep in mind three main types of planning horizons: operational, strategic and tactical.

Today, our focus will be on tactical planning. How does it set itself apart from the other two types? Why are these tactical aspects critical for FMCG-focused businesses? And what potential challenges might crop up in the planning landscape?

Natalia Morozova, IBP expert & architect at TeamIdea, is here to guide us through these questions. So grab a coffee and let's dive in.

Let us start with the basics.

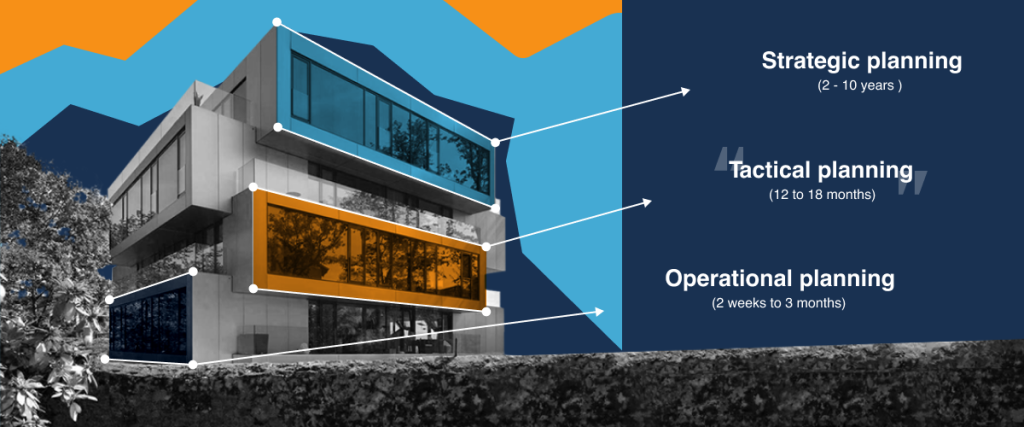

How is tactical planning different from the strategic and operational aspects?Imagine a building with different levels, each representing specific planning horizons. There are typically three of them: strategic, operational, and tactical.

At the lowest level is operational planning, focusing on short-term horizons ranging from two weeks to three months. In some cases companies plan their production in hours and even in minutes. Here, the focus is on fulfillment: fulfilling customer and production orders, as well as transportation, reacting promptly to current supply chain & demand signals. Operational planning drills down to daily and even intraday levels for precision.

Moving up, we have tactical planning, with a horizon of 12 to 18 months. This level deals with aspects such as revenue & stock management KPIs, and monthly demand volumes planning.

Lastly, there's strategic planning, covering two to five or even 10 years and focusing on broader goals like market expansion and brand development.

It's essential not to mix these different planning types. We have seen that there is a confusion between diverse horizons and IT solutions applied.

What will happen if companies mix them?

Let’s look at the case of a Consumer Electronics Company. The company often faced an out-of-stock situation, stock deficit, and they were not able to fulfill customer orders with high service level. Why?

In the electronics industry, the lead time for components necessary for producing electronic devices can be quite extensive. For instance, for electrical chips and microschemes, lead times can range from nine to twelve months. Any global event, such as a pandemic, can disrupt the supply chain and make the lead time even larger.

When you have a short planning horizon, you cannot effectively plan ahead, considering the long delivery times. However, when this company implemented tactical planning, they extended S&OP horizon from 3 to 18 months. This led to a smoother process, higher service levels, and fewer out-of-stock situations.

Why is tactical planning so crucial in the FMCG industry?

Because FMCG companies have a demand-based business. What does this mean? You have success on the market if you sense the demand of your customers, if you fulfill the demand. So it's not a push industry. You don't have control on price and volumes on the market.

If you compare FMCG to for example Oil and Gas, this is a highly competitive market where the number of players is much bigger.

In FMCG, everything is based on forecasting and sensing the demand of the end consumer. We have a challenge: how to forecast these demands. Because if the forecast error is higher than 50%, then we will have inaccurate supply planning and we will not be fulfilling the demand of our customers.

So, the first issue is demand sensing.

What other planning challenges do FMCG-focused companies deal with?

The second point is that FMCG companies, especially when we're talking about the tactical horizon, have the chance to shape demand. They can do this through promotions, marketing strategies, introducing new brands, and positioning them strategically. However, this influence doesn't happen overnight.

Imagine you want to make changes, like increasing demand for some of your products. You'd need to plan a promotional campaign in advance, prepare a marketing plan, build products’ supply for promotion etc., which all take time. So here's another challenge: FMCG companies must plan their promotional activities and marketing strategies well in advance and accurately estimate how they will impact future consumer demand.

The third challenge, which has emerged in recent years and I've already touched on it briefly, is supply chain disruption. The supply chain is no longer static or stable. New suppliers enter the market while old ones cease operations. Prices are constantly fluctuating, sometimes necessitating a switch to another supplier because the new price doesn't align with your costs or the end product's price for consumers. In the past few years, FMCG companies have faced the need for agile tools to adapt quickly when global conditions and supply chains shift.

And the last challenge is choosing the right vendor and procurement contract terms. Unlike industries such as metal and mining, where vendors are typically fixed and long-term contracts are common, FMCG companies face a dynamic market with intense competition. There's a multitude of vendors offering different prices and lead times, and with globalization, the options are even more extensive due to FMCG's universal appeal across countries. We live in a globalized world, so you have a really huge amount of options in FMCG.

Unlike specialized products like electronic chips produced in limited locations, for example, only in Taiwan on one plant, FMCG products are widely available.

So here comes the challenge of choosing the vendor, which directly impacts the final price. Price holds significant importance in FMCG, as consumers consider both quality and affordability when choosing products. In FMCG, typically you have many vendors and here comes the question, how to split the procurement between a couple of vendors? What ratio will be optimal if we have two vendors for the same raw material?

Can't you choose just one, the cheapest one?

It doesn't quite work that way in FMCG. What we often observe is that there are several vendors with differing limitations, prices, and volume capacities.

Take, for instance, an FMCG company distributing dairy products. They may source milk from small farms, offering limited quantities of a special ultra-fresh product, while also obtaining milk from another supplier that provides ultra-pasteurized milk with a longer shelf life and higher volume capacity.

So you cannot just take one. You have to provide to the end consumer some diversity. That's why typically for FMCG there are multiple vendors and you have to choose supply split among them.

What solutions do you provide in TeamIdea to address the challenge of demand planning?

Let me provide a business example. One of our customers was a big FMCG company producing conserved vegetables. They faced issues due to departments not exchanging information. What happened?

The sales department signed a big contract with a retail chain without consulting neither procurement nor marketing. This led to overcommitment and penalties for not meeting demands because of supplier’s capacity limits. And this FMCG company had to pay a penalty for not fulfilling this contract with the retail chain.

Another example: because of poor information exchange with retail chain accounts from sales department marketing wasn't aware of the retail chain's plan to introduce a similar product under its own label, resulting in lower sales and unplanned surplus stock.

Consequently, the FMCG company faced challenges in selling the large quantity of product they had produced, as the retail chain offered a similar product at a better price. To avoid surplus, FMCG company had to agree on a big sell-out and lost potential revenue.

So, how to deal with miscommunication? Setting up a high-quality Sales and Operations Planning (S&OP) process. It is implemented in every well-known and TOP International FMCG company like Danone, PepsiCo, Coca-Cola, and others. If you visit any of them, you'll find the S&OP process in place. It needs to be lean and supported by an IT system.

In general, S&OP is the answer to all the challenges we mentioned before. S&OP is a core business process for FMCG companies, benefiting all processes, but particularly enhancing demand planning. In the S&OP process inputs come from the marketing, sales, production, finance, and procurement departments, covering everything for tactical planning.

So let’s look at one more case. Dairy products producer had a forecasting process based on sales history, but the history was not cleaned from outliers and promotion effects. When forecasting, if wholesales orders or promotional sales are not filtered out, it leads to inaccurate and unstable forecasts. This happens because during promotions, price changes affect sales volumes, but this is not representing regular sales patterns.

What we did for them was an implementation of an IT solution which helped to automatically clean the sales history from promotion effects for the periods on which promotion took place. There are different algorithms for how to do this.

-

One approach is to ignore sales history during promotional periods, but this may discard valuable data if promotions are frequent.

- The second method is to estimate promotion uplift on top of baseline sales from past promotions using automated algorithms, providing a reliable baseline for forecasting

“Implementing advanced history cleansing and forecasting techniques resulted in significant increase in forecast accuracy, up to 75% at the SKU-day level”.

So if we want to increase focused accuracy, we need to do historical sales cleansing. We have to work on high quality baseline forecasts. We need a forecasting algorithm which will be able to forecast promotion uplifts.

And there's also the possibility to consider the product life cycle, when an FMCG company introduces a new product to the market. Sales start from zero and ramp-up during phase-in, then the product matures, and sales stabilize. Finally, there's a phase-out period when the product is discontinued.

What about supply chain disruption?

Do we have some IT solutions to answer this challenge?

Yes, in the past, maybe 10 or 15 years ago, FMCG companies used to have a relatively long period between recalculation of the demand and supply plans. Previously companies could make tactical forecasts once per month.

But today we offer IT solutions based on SAP IBP that automate the process, allowing for multiple daily updates based on the most recent data. This agility helps companies adapt quickly to supply chain changes, price fluctuations, or alterations in promotion quantities or periods.

And finally, how do you address the challenge associated with vendor contracts?

Typically vendor limitations, for example, minimum price of the order, minimum quantity, minimum weight of the order and other contract terms are discussed. It can be different for different vendors.

Some transportation limits may be part of the contract. Like if you don't order a full truckload, your order might not be given first priority or might not be fulfilled at all if the truck isn't full. This can lead to suboptimal transportation costs. Therefore, the question is: Which lot size, minimum order limits, order and delivery cycle should be discussed with each vendor?

Here also SAP Integrated Business Planning can help because it modules multiple versions for finding optimal decisions between order placing, transportation costs and inventory holding costs. There are mathematical algorithms that optimize target function and that can help you to find cost effective supply options.

Key takeaways

-

Tactical planning in FMCG

Tactical planning in FMCG involves managing revenue, stock, and monthly demand over a 12 to 18-month horizon. It bridges the gap between short-term operational planning and long-term strategic planning. -

Why is tactical planning so crucial?

Tactical planning is crucial in FMCG due to its demand-based nature. Accurate forecasting and advanced planning of marketing strategies are key to meeting customer needs and staying competitive. -

Solutions TeamIdea provides

Implementing a high-quality Sales and Operations Planning (S&OP) process helps integrate inputs from various departments. This improves communication and coordination, making planning more effective. -

What about supply chain disruption?

Modern IT solutions, like SAP IBP, allow for frequent updates to demand and supply plans. This helps FMCG companies quickly adapt to changes in the supply chain and maintain smooth operations. -

How do we address the challenge associated with vendor contracts?

SAP IBP can model various scenarios to optimize order placing, transportation costs, and inventory holding costs. This ensures cost-effective supply chain management and better vendor relations.